It’s one thing to be focused on your own experience, but what about your industry’s ecosystem and its effect on the customer experience?

Two recent personal experiences with banks highlighted the need to be aware of an industry’s entire ecosystem and how it can improve — or worsen — an individual company’s experience.

In each experience, I applied for a new account with a bank. One was a credit card account, and the other was a checking account. And in each experience, the bank wanted to check my credit report.

The only problem? I have chosen to voluntarily freeze my credit reports with the three major U.S. credit score providers — Experian, Equifax, and TransUnion. This freeze, which has been free to consumers since 2018, is a highly recommended safety feature.

According to the Federal Trade Commission (FTC), “a credit freeze restricts access to your credit report, which means you — or others — won’t be able to open a new credit account while the freeze is in place. You can temporarily lift the credit freeze if you need to apply for new credit.”

Yes you can “temporarily lift the credit freeze,” but you need to remember to do so. That’s where banks should be providing proactive customer service.

I didn’t remember that my credit reports were frozen. But surely the banks are aware of this feature, given that they check millions of credit reports every year? It’s part of their ecosystem — the related experiences their customers have that are not directly associated with the bank but nonetheless remain a key component to customer success.

So how hard would it have been for the banks to proactively remind me before they checked my credit report?

“Just a heads up that we’re going to check your credit report, and if it’s frozen we won’t be able to access it. So please remember to unfreeze it before submitting your application.”

This is an example of how the many ways companies communicate with customers each have the opportunity to improve the experience with just a little forethought. (Related: Customer Retention Rate: Why You Should Care and How to Calculate It)

Not surprisingly, l was declined by both banks. What was surprising, though, is that neither bank told me why I was declined, with one noting that I would receive a letter in the mail in 7-10 business days with an explanation.

Seven-to-ten business days is like an eternity in today’s digital world.

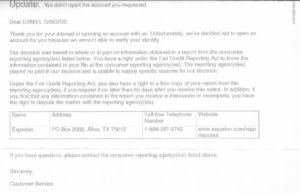

The bank’s mailed explanation letter began: “Thank you for your interest in opening an account with us. Unfortunately we’ve decided not to open an account for you because we weren’t able to verify your identity.”

There was absolutely nothing in the letter about credit freezes or temporarily lifting a freeze or even the ability to re-apply after lifting a freeze.

I already knew why I was declined, and the bank knew why I was declined, and I knew that the bank knew why I was declined. Then why the lack of transparency?

The letter, which should be displayed on the screen instantly instead of arriving in the mailbox nearly two weeks later, should have simply stated: “We were unable to access your credit report because you have it frozen. Please unfreeze it and try again.”

The experience I had literally left me with only one choice — go to the competition. Not only did I not care to wait 7-10 days for a letter telling me what I already knew, but neither bank gave me the option to try again.

Are these companies so well off that they’re not interested in acquiring any new customers?

By fully understanding your company’s larger ecosystem, and by helping your customers navigate through it, you can become a trusted resource that is rewarded with more new customers, higher customer retention, and loyalty for years to come.

Related: Why Customer Experience Trumps Traditional Marketing

Image by Markus Steidle from Pixabay